Business Loans Ga

Business loans ga ~ Traditional bank business financing is usually the first choice of any business including Georgia small businesses. We help you get approved even if you are a startup have credit issues or have no collateral. Indeed lately is being searched by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the article I will discuss about Business Loans Ga Financial analysis shows that Georgia is one of the best places for small business owners to grow their businesses.

Source Image @ howtostartanllc.com

How To Start A Business In Georgia A How To Start An Llc Small Business Guide

Businesses that get loans will also get other support as well. It is possible and easy to secure working capital loans or a small business loan in the State of Georgia. Your Business loans ga image are available in this site. Business loans ga are a topic that has been hunted for and liked by netizens today. You can Find and Download or bookmark the Business loans ga files here

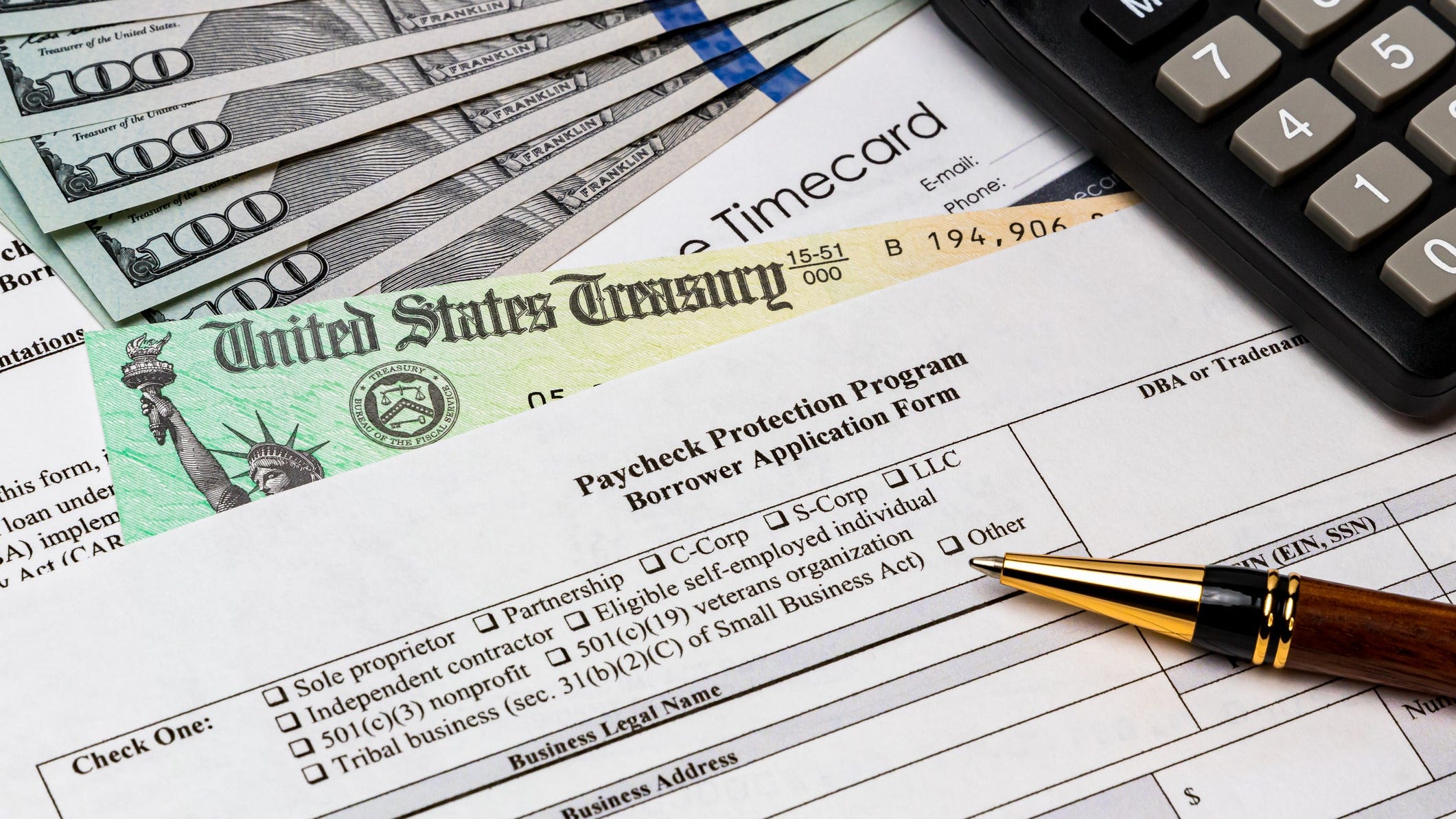

Business loans ga - You should consider taking one if you need to start a business or boost an already existing one. It offered loans to help small businesses and non-profits keep their workers employed. Paycheck Protection Program PPP The Paycheck Protection Program PPP ended on May 31 2021. Georgia Banking Company offers flexible loans to meet the financing needs of your business.

Start or expand your business with loans guaranteed by the Small Business Administration. Is standing by to provide you with all the help you need to get the financing your small business needs. 5 STAR HEATING COOLING INC. Acquisition loans Agribusiness lending for farming machinery livestock purchases etc.

Open today until 700 PM. Bad Credit Business Loans Georgia. Georgias Regional Commissions offer small business loan assistance gap financing that may include SBA 504 and 7 a loans Revolving Loan Funds Rural Loan Funds and USDA Business Industry Loans. Ameris Bank offers the following types of small business loans in Georgia.

The following businesses have been approved for loans through the Paycheck Protection Program. Loans arent the only source of financing to consider in Georgia. Many of the major SBA-approved. Nowadays while approving no credit check short term loans in Georgia financial companies only see if you are in a financial position to able to pay off the loan within the agreed term which is usually a maximum of 3 months.

Fund seasonal cash flow to smooth operations. At any stage and any need let us help your business succeed. Small Business Loan Lenders in Georgia. Powered by the companys network of third-party lenders consumers can shop for personal loans business loans credit cards mortgages and other types of loans.

Access low interest credit lines and long term loans and get funding in 72 hours or less. The Small Business Administration SBA offers programs that can help your business if its been affected by the coronavirus pandemic. Georgia business grants include those for businesses in specific counties businesses in certain industries and those that can provide economic development in distressed regions. Funds may be used for business acquisition startup equipment debt refinance working capital inventory tenant improvement and partner buyout.

Since we are a locally owned community bank we are always available to help you and can give you a quick answer that you deserve. Whatever your situation may be SBA-backed loans are extremely useful for any small business in Georgia and SBAExpressLoans Inc. For an online loan for bad credit in GA up to 1000 there is no requirement of a traditional credit check from lenders like CashUSAToday. Consumers can even compare rates from multiple lenders using money tools or use other financial management services with a membership.

SBA loan programs offers both term loans and lines of credit to small businesses. Use Lender Match to find lenders that offer loans for your business. How to Get a Loan to Start a Business in Georgia. Our loan experts are here to help your small business.

New and used equipment. Startup business loans Augusta Ga is for small business owners or aspiring entrepreneurs who need business startup funding to grow the business generate cash flow and improve business credit for more financial opportunities. Backed by the Small Business Administration SBA financing offers many flexible options usually resulting in lower monthly payments. Get directions WhatsApp 770 830-3481 Message 770 830-3481 Contact Us Get Quote Find Table Make Appointment Place Order View Menu.

We also help you secure business loans and credit lines with great terms even if youve been told no at your bank. Small business loans in Georgia are defined as loans that range from 100000 to 1000000. Find small business financial assistance programs in Georgia including in Atlanta Augusta Savannah and statewide. And its not just us.

With the longer terms of an SBA loan small businesses can acquire more capital with affordable monthly payments. Flexible repayment terms. We also help small business owners know how startups get funding and initiate creative funding to invite investors. Atlanta GA area business owners seek SBA loans because of the great rates low fees and long term duration of financing.

For loans secured by longterm assets such as. Benefits and Best Uses of Atlanta SBA Loans. Georgia has about 18290 small to medium size businesses that received PPP loans in excess of 150000. Everything from low cost loans to grants capital or funds to pay certain operating expenses may be offered.

The reason that traditional banks credit unions and community lenders are usually the first choice of any business looking for debt financing is the fact that these lenders offer the lowest rates and best terms of all commercial lenders. State Small Business Credit Initiative SSBCI Micro LoansCDFI City of Atlanta Loan Programs Green Loans Innovative Entrepreneurs Rural Business Loans Federal Grants Loans Foundations in Georgia Commercial Cash Flow Management. COVID-19 Small Business Loans. Below is Georgias list of traditional and alternative funding as well as federal loans and grants.

There are also a variety of business grants available that do not require you to pay them back.

Source Image @ aceloans.org

Source Image @ www.eu4business-ebrdcreditline.ge

Source Image @ www.pinterest.com

Source Image @ www.pinterest.com

Source Image @ www.atlantaga.gov

Source Image @ www.signaturebankga.com

Source Image @ www.savannahnow.com

If you are searching for Business Loans Ga you've arrived at the ideal location. We have 8 graphics about business loans ga including images, photos, photographs, wallpapers, and more. In such page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

If the posting of this web page is beneficial to our suport by revealing article posts of this site to social media accounts to have such as for example Facebook, Instagram among others or may also bookmark this blog page together with the title Georgia Ppp Loans Search A List Of Who Got Paycheck Protection Loans Work with Ctrl + D for laptop or computer devices with Glass windows operating system or Command line + D for computer system devices with operating-system from Apple. If you are using a smartphone, you can also use the drawer menu from the browser you utilize. Whether its a Windows, Apple pc, iOs or Android os operating-system, you'll be able to download images utilizing the download button.