Business Startup Loans Canada

Business startup loans canada ~ Startup business loans from the Canadian government. 90 days of no payments for existing business. Indeed recently has been searched by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the article I will talk about about Business Startup Loans Canada While some loans can be processed within a week startup business loans can take up to a month or more so youll need to be prepared for this.

Source Image @ loanscanada.ca

Startup Business Loans Loans Canada

Our terms and conditions dont change without due cause. Interest Rates for Start Ups as low as 7. Your Business startup loans canada images are available. Business startup loans canada are a topic that has been searched for and liked by netizens today. You can Find and Download or bookmark the Business startup loans canada files here

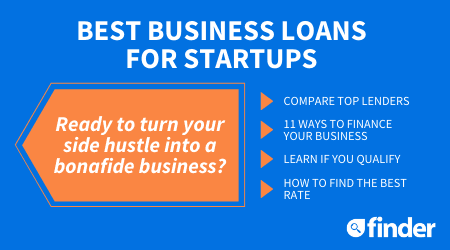

Business startup loans canada - The loans max out at 10 million and can be used at the discretion of the business. If no employee is compensated above 100000 and at least 75 of the money goes to paying workers the entire loan may be forgiven. Futurpreneur Canada Side Hustle Futurpreneur Canada If youre a young professional 18 to 39 years old with a full-time job you can get up to 15000 and mentoring to launch or grow a side business. Loans and capital investments Government loans loan guarantees venture capital and other types of debt and equity.

Below well take a look at loan options for Ontario based businesses. To get unsecured startup business loans from OnDeck your business needs to be 12 months old with annual revenue of 100000 while your personal FICO score should be no less than 600. Business loans are often applied for to start a new business to expand an existing business to fulfill orders and so on. The better your credit the lower the rate.

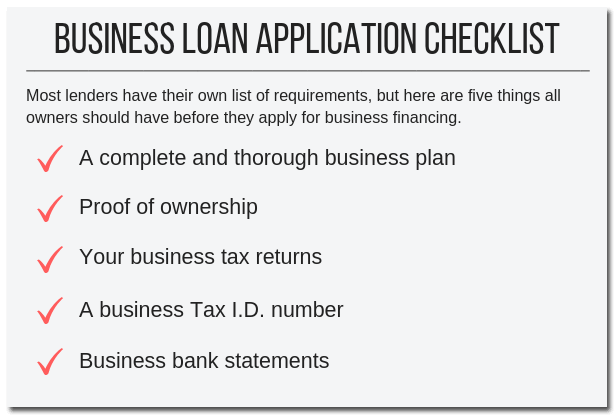

So if you have creditors bearing down on you or an essential piece of machinery that just broke down youll likely find yourself anxious for the fast relief this type of financing provides. A variety of business loans and financing methods are available to startupsincluding SBA microloans asset-based loans business credit cards and morealthough it can be difficult for new small businesses to access funding. This can include your home equity your vehicle title or the equipment you use for your business. Small business loans from 5000 to 500000 from top business loan lenders in Canada.

Public funds to help springboard your business venture. There is no specific type of a business loan that is called a startup loan but a whole array of different products that may or may not fit your company at this point in your journey. Easy and fast approval in 24 hours. There are a number of regionally based programs as well.

Futurpreneur Canada offers several different financing programs to support entrepreneurs aged 18 to 39 including one that provides startup small business loans of up to 60000. Government-backed business startup loans are funded by the Canadian government and come with lower interest rates and more flexible terms than private loans. This loan company doesnt offer its services to a number of industries including adult entertainment drug dispensing firearms vendors vehicle dealers and. The goal of the HASCAP Loan program is to support highly-affected Canadian businesses who may have been ineligible for other government programs or otherwise more affected than other businesses.

An example is the Canada Small Business Financing Program CSBFP loan. A business startup loan provides financing to newer businesses. Benefit from an affordable rate no application fees and no penalties for early or lump-sum payments. If you dont already have savings this can be a tough reality to face.

Thats right we can get you cash and the equipment you need for a start up. Apply for your business loan online. But Canadian businesses can tap into startup business loans to help get them where they want to go. You must also plan your project ahead of time Ms.

Use the Funding Database to tap into over 1500 funding programs including grants loans tax credits and angel investors available for Canadian small business owners. The majority of small businesses in Canada finance their business with personal savings. Based on personal credit scores startup loans are easier to qualify for and can be used for working capital equipment purchases inventory or whatever else your business needs. Postpone principal payments the first 6 months and repay the loan at your pace over a 5-year period.

Use the Funding Database search tool to generate a personalized list of funding programs offered to businesses in your region your industry and for your particular funding needs. Incorporation will enable you to protect and separate your businesss credit from your personal credit. A startup business loan is any type of financing available to businesses with little to no history. Up to 5 Million for existing businesses bad credit is ok.

The Smarter Loans Staff is made up of writers researchers journalists business leaders and industry experts who carefully research analyze and produce Canadas highest quality content when it comes to money matters on behalf of Smarter Loans. Such loans are usually paid back over a specific period of time in installments. Financing tailored to your needs. The goal of a business loan is to repay the loan from the business income generated by.

Using your line of credit to finance your start-up may be justified but you must have a game. Futurpreneur Canada Get a loan of up to 25000 to start a business in Canada without having an established credit history. Micro Loans World Wide Start ups Low Credit scores ok. The goal of HASCAP is to provide new support so Canadian businesses can weather this COVID-19 storm and be ready for a robust recovery that will.

Collateral A secured startup business loan will require collateral to back up the loan. The loan can be forgiven however if certain requirements are met. Many companies use startup business financing and funding for their small businesses in Toronto Vancouver Canada to get out of a tough spot. Startup business loans are a category of debt instruments aimed at entrepreneurs starting a business or young small businesses just starting to grow.

Processing time Startup business loans sometimes take longer to process compared to other types of loans.

Source Image @ www.finder.com

Source Image @ www.opstart.ca

Source Image @ ontariobusinessgrants.com

Source Image @ loanscanada.ca

Source Image @ www.thinkingcapital.ca

Source Image @ ontariobusinessgrants.com

Source Image @ www.bdc.ca

If you are searching for Business Startup Loans Canada you've arrived at the perfect place. We have 8 graphics about business startup loans canada adding pictures, photos, pictures, wallpapers, and more. In such web page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

If the posting of this web site is beneficial to your suport by spreading article posts of the site to social media marketing accounts to have such as Facebook, Instagram among others or can also bookmark this website page together with the title Small Business Loans Apply Online For Up To 100 000 Bdc Ca Use Ctrl + D for laptop or computer devices with House windows operating system or Demand + D for pc devices with operating system from Apple. If you use a smartphone, you can also use the drawer menu in the browser you utilize. Whether its a Windows, Mac, iOs or Android operating system, you'll be able to download images using the download button.